Our projects vary in size and complexity, but our results are always the same:

moving you from gray uncertainty to a clear direction.

Despite a significant investment, our client, a major multinational consumer-packaged goods company, experienced a market share decline with several of their brands in South Africa. An informed perspective on the situation was commissioned to provide key recommendations for sustaining the business or deciding to exit the market.

The threat to the client’s two brand players was coming almost entirely from one local powerhouse brand. It held close to 50% of the value share alone, and commanded strong loyalty from entrenched consumer base driven by heritage. That brand also had a much broader distribution through traditional trade outlets (and smaller mom & pop shops).

Those smaller traditional trade were not strongly supported by our client, however they made a significant difference for the competition as the small store owners were incentivized to push other brands directly to consumers.

Our client had 2 different brands for the same type of product, which caused some confusion and dilution of brand loyalty. Specific recommendations for sustaining business, based on sound information and strategic insight was developed:

Four weeks

Despite a significant investment, our client, a major multinational consumer-packaged goods company, experienced a market share decline with several of their brands in South Africa. An informed perspective on the situation was commissioned to provide key recommendations for sustaining the business or deciding to exit the market.

The threat to the client’s two brand players was coming almost entirely from one local powerhouse brand. It held close to 50% of the value share alone, and commanded strong loyalty from entrenched consumer base driven by heritage. That brand also had a much broader distribution through traditional trade outlets (and smaller mom & pop shops).

Those smaller traditional trade were not strongly supported by our client, however they made a significant difference for the competition as the small store owners were incentivized to push other brands directly to consumers.

Our client had 2 different brands for the same type of product, which caused some confusion and dilution of brand loyalty. Specific recommendations for sustaining business, based on sound information and strategic insight was developed:

Four weeks

Our Fortune 500 client completed a comprehensive market analysis to better understand its consumers and overall competitive landscape.

Clarteza partnered with this client to use new knowledge and explore white space opportunities to develop new product ideas by identifying segments, drivers, and occasions for new product ideas.

First, to ensure that new product ideas leverage rich segmentation data, Clarteza developed a summary profile of the specific segments/demand spaces, including:

This was our road map to co-create initial ideas with the client.

Then we looked at the competitive landscape by leveraging the Clarteza Product Portal which was created earlier for this client:

In our uniquely distinctive workshop experience Innovation by Design, Clarteza reviewed the information, provided inspiration and lead through the innovation process to:

This approach increases the relevance of the ideas with target consumers and therefore improves chances for success during launch.

One to Two weeks

Our Fortune 500 Consumer Packaged Goods client wished to understand current consumer perceptions and usage of one of their flagship products to uncover any hidden barriers. The objective was to create and evaluate a new product that meets consumer expectations and solves the right consumer problem. Ultimately, our client wanted to create a product or products that was used more frequently. The project was conducted in four countries: the U.S., France, Italy and Argentina.

Our client received a multi-dimensional analysis that also provided certainty of a direction for the new product prototypes. The insights that were uncovered in different countries identified different behaviors in consumer product application as well as in overall category perception. As a result, the client was able to identify which country was more ready for the new product, and which type of consumers needed some education and preparation before the rollout.

Eight to Twelve weeks

Our client wished to launch a baked-good product with a new brand. The current brand was perceived by their consumers as classic and traditional, and appealed to people over 50+. The purpose of launching the new brand was to create excitement in the category and appeal to millennials and therefore increase growth.

The new brand, however, if taken out of context, could have been seen as confusing or polarizing. While the younger audience felt the brand was edgy, innovative, fun, and unique, our client wanted to make sure it did not alienate their current customer base.

the power of the pack

visual communication assesment

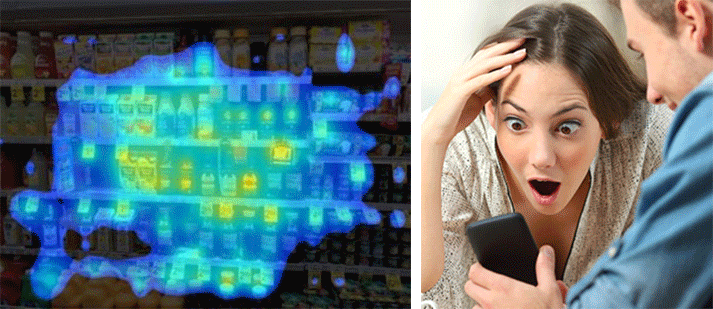

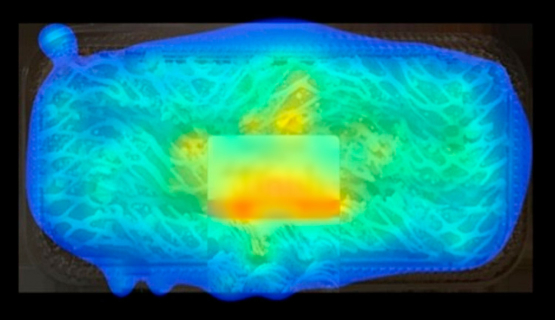

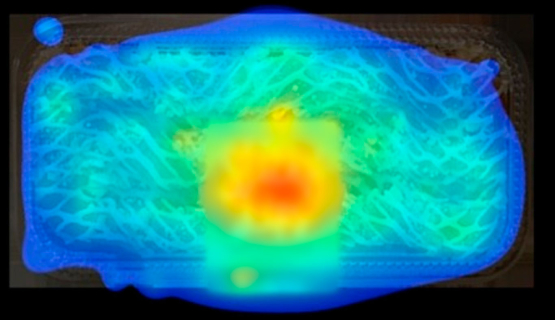

We evaluated the products’ elements of noticeability. We conducted comprehensive online research to understand respondents’ overall perception, brand preference, and likelihood of product purchase.

Techniques applied:

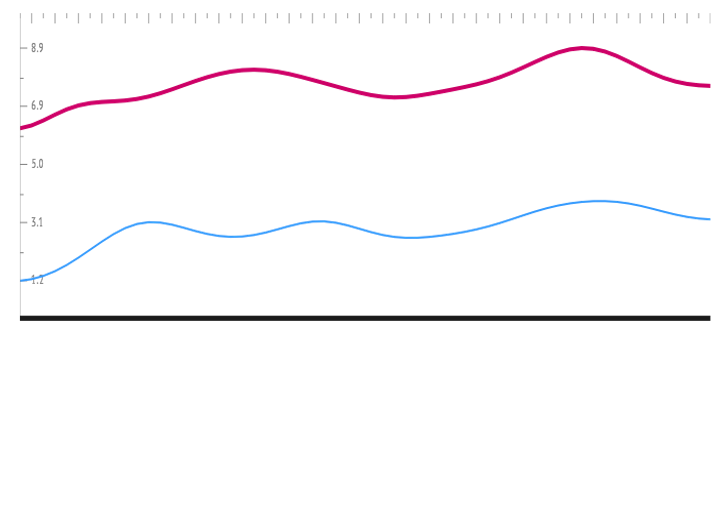

Brand and communication evaluation: we use fusion evaluation to capture data and emotions

Edgy/Youthful/Polarizing

Current/Traditional/Classic

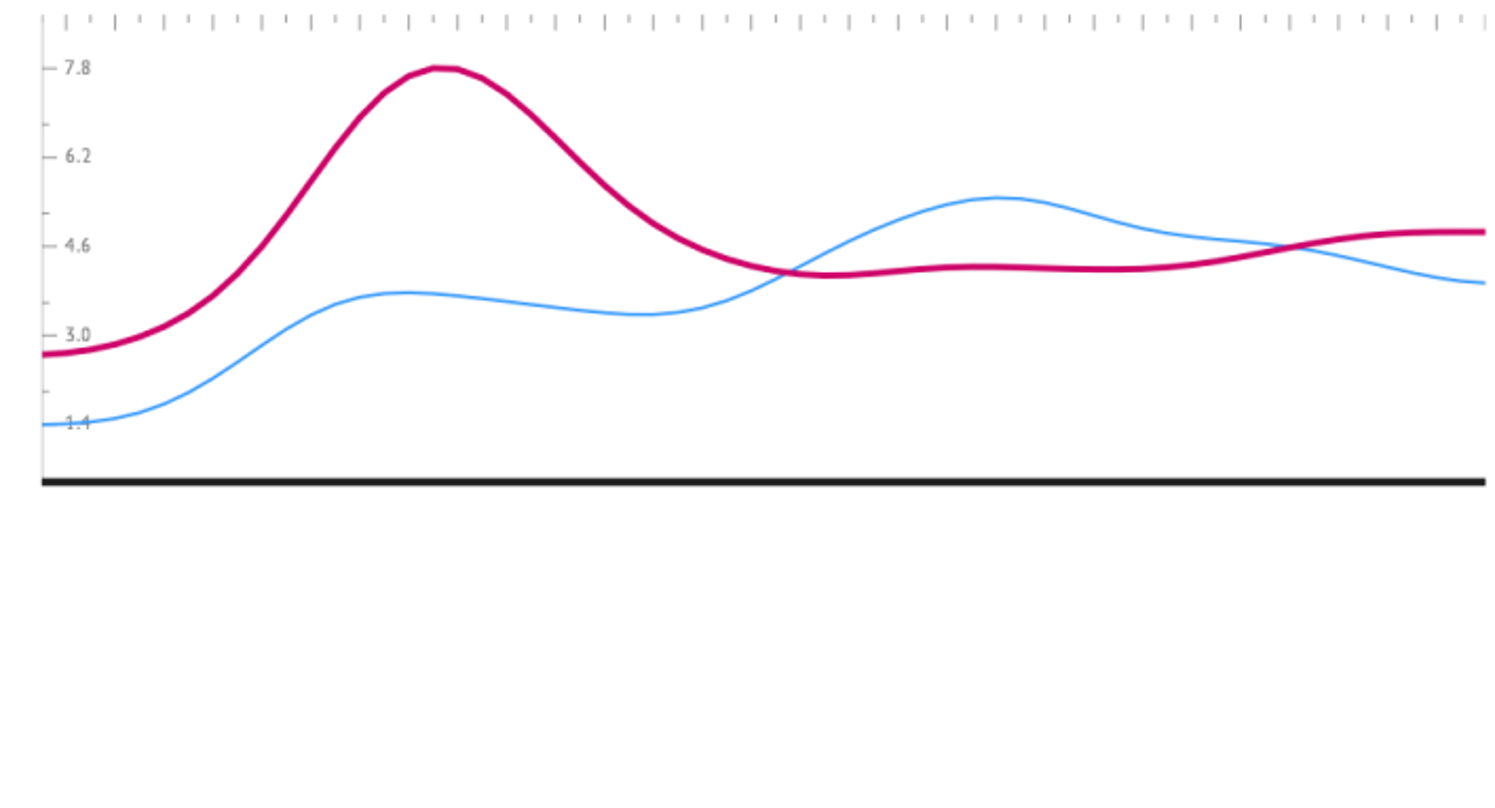

When viewing the Edgy/Youthful/Polarizing brand, there was a spike in cognitive load for participants age 41-60 when first viewing the brand. There was no corresponding spike when first viewing the Current/Traditional/Classic brand.

noteThese results were captured by exposing people for 15 seconds to 2 different brands monadically. We recorded their micro-facial emotional reaction to the brand which was instantly analyzed by AI algorithm.

We looked for emotional content in stories people shared about baked goods

Clarteza analyzed a significant amount of unstructured text to find themes and underlying emotional factors in consumers’ language.

We were able to uncover answers to questions we haven’t even asked and could identify valuable insights that changed the trajectory of the brand’s launch

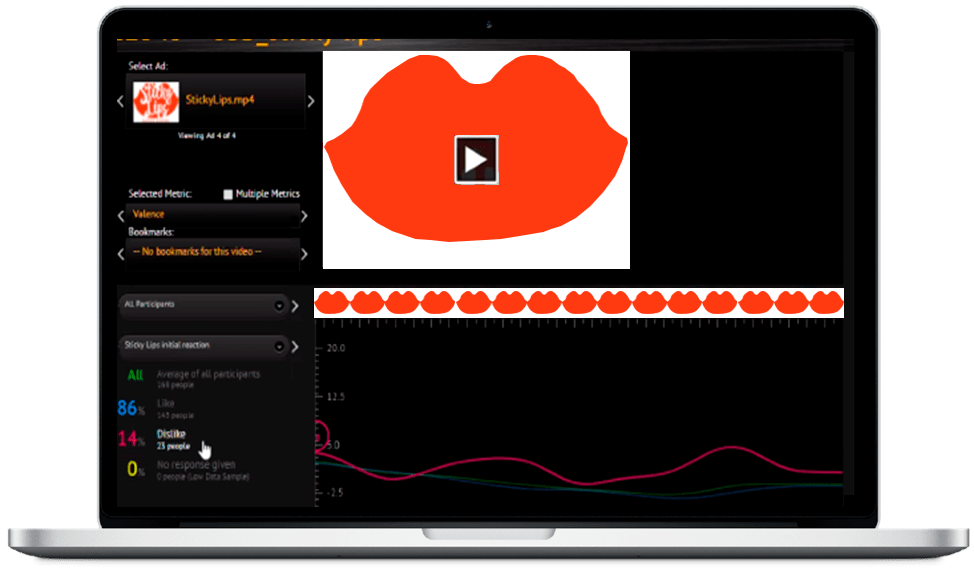

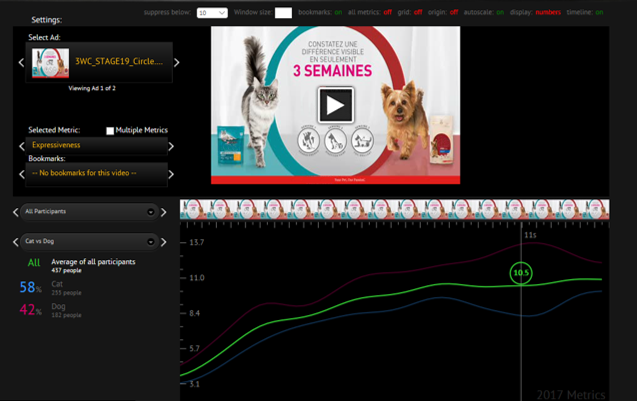

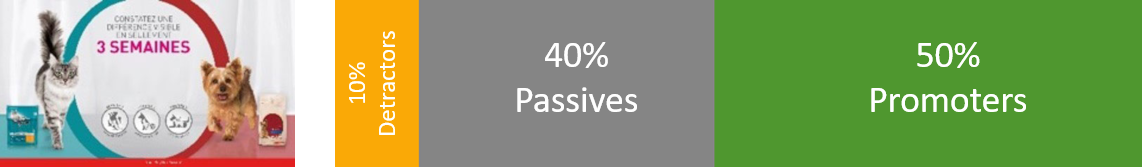

Our client wished to evaluate communication visuals to convert non-buyers to users. They developed a three-week consumer challenge where a consumer would test a product for three weeks to determine if they could notice a detectable difference. The objective of this campaign was to convert non-buyers and solidify loyalty with current buyers.

We applied a fusion research methodology and leveraged AI to evaluate consumers' overall unconscious and then cognitive preference for the most appealing visual communication campaign, which we then optimized. We followed the following process:

1 Branding and communication evaluation: PREVUE - unconscious processing

Happens in seconds and is

an unconscious process

Occurs when the brain notices

and starts to process

Once noticed and recognized,

will they want to buy it?

2 Microfacial Expression AI evaluation using algorithm to detect up to 20 emotional responses

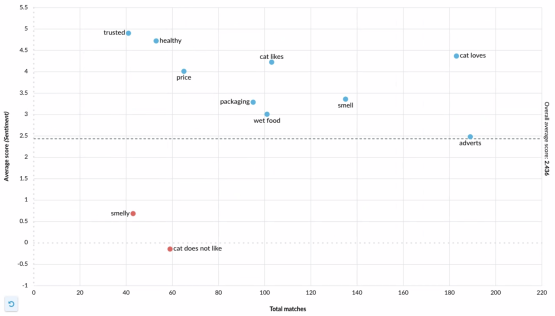

3 Areas people liked most – and why: cognitive noticeability, appeal & ability to connect

| Message |

Total Exact & Contextual Matches |

| animals, cat and dog | 73% |

| health, good health, healthy | 51% |

| difference | 35% |

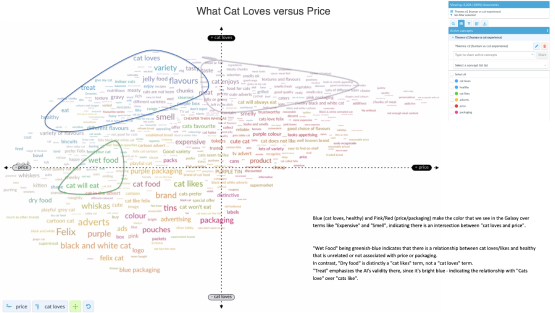

4 What we learned using AI, Natural Language Processing analyzing open ended responses:

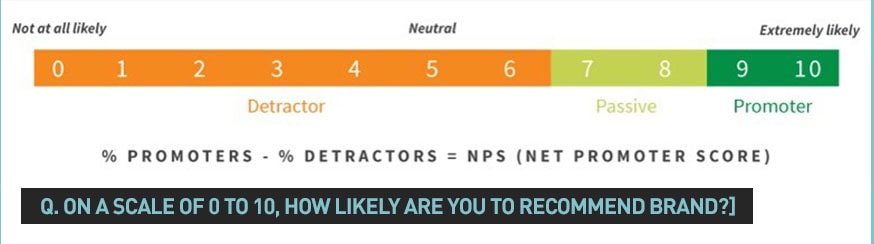

5 How likely are you to recommend a brand?

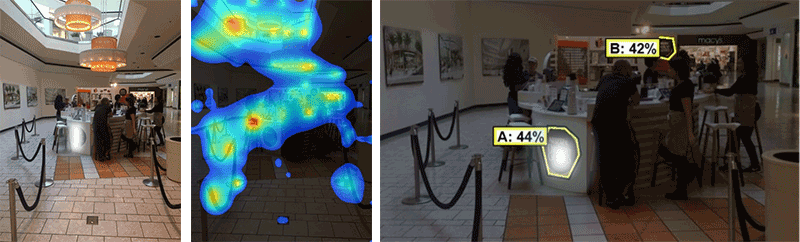

Clarteza team was asked to evaluate a product launch that included an experiential marketing campaign, where consumers interacted with the product in a ”pop-up café” and were guided through the experience by brand ambassadors.

As this initiative was a key pillar in the marketing plan, the client wished to understand its effectiveness prior to rolling it out to other markets.

Clarteza employed diagnostic fusion research methodology, leveraging both System 1 (unconscious brain processing) and System 2 (cognitive thinking) thinking, in order to fully capture the user experience, its impact, and to highlight opportunities for optimization.

To quickly and efficiently assess the effectiveness of this experience, customers were first led through product introduction. Then, a combination of Predictive, Ethnographic, directionally Quantitative and in-depth Qualitative interviews were conducted.

We applied the following methodology:

Clarteza presented learnings that were truly surprising to the client, based on:

Some of these observations were not even on the client’s radar. They included:

The takeaways were so impactful that the following phase of the road show was significantly more successful. All daily Key Performance Indicators (KPIs, including daily sales), were surpassed after our diagnostic analysis was received and recommendations applied.

Two weeks

together!